Ecosystem Fundamentals

The Prime Growth Approach

By Steve Waters

Founder / CEO, SMB Intelligence

• Address the disconnect in the small business ecosystem between solution providers and small business owners

• Prioritize new & high growth firms, and more effectively deliver growth solutions relevant to their current growth priorities

• Increase the economic and social impact of those solutions

01

Understand nine key dynamics of the small business ecosystem

We define substantial growth as both substantially increasing revenues and adding new jobs. We define incremental growth as gradually increasing revenues.

2. The vast majority of small businesses do not experience substantial growth and do not create new jobs – they start small and stay small2.

3. The vast majority of small businesses are not receptive to new solutions in general, even if a “better” solution exists3. Once they establish a solution they are not likely to switch providers unless the solutions stops functioning.

4. Which small businesses are currently most likely to be growth-motivated and receptive, to experience substantial growth and to create new jobs, continually changes4, as firms enter and exit the sector and move through development stages.

5. Traditional small business segmentation (industry, revenues, company size, company age, and digital engagement), provides limited insight into which firms are currently likely to be growth-motivated and receptive, to experience substantial growth and to create new jobs, as the strongest indicator is current development stage5.

6. Growth-motivated owners often struggle to navigate the ecosystem to find needed solutions at the right time6.

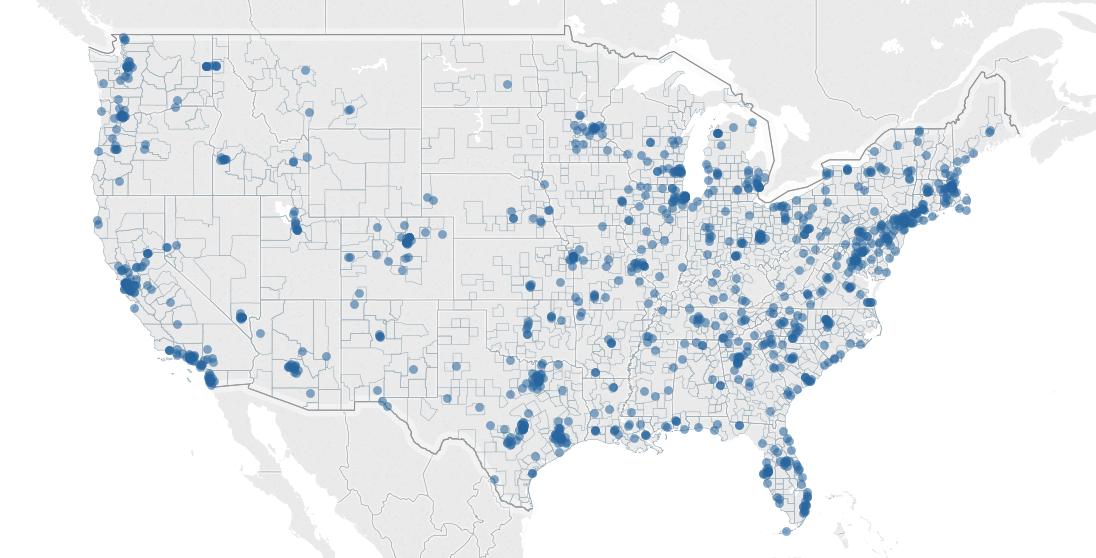

7. Small business dynamism is declining and geographic inequality in the sector is rising: there are less new businesses being formed at any time since the 1970’s, and they are increasingly concentrated in already prosperous areas – economically distressed communities are being left behind7. Firms in distressed areas are more likely to experience challenges accessing the solutions they need to startup and expand8.

8. The number of women-owned small businesses is increasing significantly faster than men-owned firms9, but they are more likely to experience challenges accessing the solutions they need to startup and expand10.

9. Minority owners have higher rates of business creation than their counterparts11, and immigrants start businesses at nearly twice the rate as their native-born counterparts12. However, minority and immigrant-owned firms are more likely to experience challenges accessing the solutions they need to startup and expand13.

02

Understand four key elements of small business owner mindset

2. Owners perceive themselves as industry category specialists, not as “small business owners”16.

3. Owners have three mindsets when it comes to engaging with solution providers: sourcing, operating, and breaking point17.

4. Owners are most likely to discover new solutions through other owners18.

03

Prioritize prime growth firms

Growth-based classification uses development stage, growth format and growth scale to categorize firms, rather than traditional small business segmentation (industry, revenues, company age, company size, and digital engagement).

The purpose of the standard is to identify prime growth firms and group them into nine segments based on their current growth priorities.

Prime growth firms are independents or small chains, that are employers, with a commercial location(s), that are currently at a seed (new) or expansion (high growth) development stage.

Why this matters

Prime growth firms are the small businesses currently most likely to be motivated by growth19 and receptive to new solutions20, and if successful in their current growth plans, to experience substantial growth21 and create new jobs22.

When you can identify prime growth firms and deliver solutions that support their current growth priorities, you can better prioritize your resources and increase your economic impact.

Traditional small business datasets and segmentation (revenues, company age, company size, digital engagement) do not allow you to identify prime growth firms or determine current growth priorities, as the key indicators are current development stage, growth format, and growth stage23.

04

Continually monitor the sector to identify new prime growth firms

Why this matters

Which firms are currently considered prime growth continually changes, as the sector churns with new firms entering, failed firms exiting and surviving firms moving through development stages24.

05

Segment prime growth firms by current growth priorities and align your value

Growth priorities refer to the big picture context of an owner’s current growth plans – the format and scale of growth the owner is currently working to accomplish.

For example: launching a new single establishment firm, expanding an existing single establishment firm into a small chain by adding a second establishment, expanding an emerging small chain by adding an establishment, expanding by relocating the firm or an establishment, or allocating recently raised funds to support substantial growth.

Growth priorities are determined by combining current development stage, growth format, and growth scale.

Why this matters

Owners live in the moment25 and want solutions to current priorities, not generalized value26. When you segment firms by their current growth priorities you can position your solutions to support those priorities, making your solutions more relevant and useful, and your organization a more integrated and valuable part of the small business ecosystem.

Traditional small business segmentation does not provide insight into current growth priorities, as the key indicators are current development stage, growth format and growth scale27.

06

Position your message to be industry-specific

Owners perceive themselves as specialists in their industry category, not “small business owners”28. They also perceive their challenges to be unique. The more specific your message is to their industry and category, the more likely those firms will perceive you to understand their needs.

07

Proactively engage prime growth firms

If your solutions are only relevant to specific prime growth segments, then only engage with those.

Why this matters

Owners are challenged to navigate the ecosystem themselves to find and acquire the solutions they need to startup and expand29, and are also only likely to be receptive for brief periods in their business lifecycle30.

While all organizations should be using inbound (content) marketing at some level to ensure they can be found online when an owner hits a breaking point, if you are waiting for prime growth firms to find you, there is a good possibility they can’t or won’t.

Owners do engage with organizations through proactive outreach31 – however, your engagement will be low if the value and content are not aligned to the current growth priorities and industry of that owner.

08

Determine if owners are recommending you

Why this matters

The number one way owners discover new solutions is by talking to other owners32. If your existing and past clients are not finding success with your solutions, you can be sure they are telling other owners.

This simple dynamic can undermine any outreach efforts you’re currently undertaking, essentially creating an army of owners telling other owners not to work with you. If you have an underlying issue with your product or service, you want to understand and fix it immediately.

09

Identify & support prime growth firms in economically distressed communities and with underserved owners

The number of women-owned small businesses is increasing significantly faster than men-owned firms35, but they are more likely to experience challenges accessing the solutions they need to startup and expand36.

The number of minority-owned small businesses is increasing at a faster rate than non-minority owned37, and immigrants start businesses at nearly twice the rate as their native-born counterparts38. However, minority and immigrant-owned firms are more likely to experience challenges accessing the solutions they need to startup and expand39.

Why this matters

We believe that pursuing inclusive economic growth and making the economy work for more people is not only the right thing to do, it also makes economic sense40.

When you support prime growth firms in economically distressed communities and with underserved owners, you can increase the economic & social impact of your organization.

Notes

We differentiate between “substantial” and “incremental” growth. We define substantial growth as rapidly increasing revenues and creating new jobs (eg. adding an establishment). We define incremental growth as gradually increasing revenues.

We define a firm as being “growth-motivated” when they are currently focused on pursuing substantial growth.

References

2. The overwhelming majority of small firms do not grow by adding employees from year to year or even over three year periods. Approximately 80% of small businesses do not grow at all, even over a relatively long period. Most surviving small businesses do not grow by any substantial margin – most start small and stay small. Pugsley, Benjamin Wild and Erik Hurst. “What Do Small Businesses Do?”, Brookings Papers On Economic Activity, Fall 2011. Available online. Only 22% of small businesses are planning to hire additional employees in the next 12 months. Bank of America. “Small Business Owner Report”, Spring 2018. Available online. 22% of owners are planning to hire new employees in 2018. TD Bank. “2018 Small Business Survey”, May 2018. Available online. 71% of owners expect savings from the 2017 tax policy changes, however only 14% of those plan to use those savings to hire more employees. Bank of America. “Small Business Owner Report”, Spring 2018. Available online. Seasonally adjusted net 20% (of small business owners) plan to create new jobs. NFIB. “NFIB Small Business Jobs Report”, NFIB, June 2018. Available online. Over the next 12 months 31% of small business owners expect the overall number of jobs at their company to increase, 62% expect it to stay the same, and 7% expect a decrease. Wells Fargo. “2018 Small Business Index Survey”, April 2018. Available online.

3. In a given year for a given category, only 7% of small business owners reported switching their solution provider, and 68% reported never switching. Haque, Naumi. “Small Business Owners Never Switch Suppliers”, CEB, October 28, 2012. Available online. Waters, Steve. “Why the Vast Majority of Small Businesses are Unreceptive to new Solutions”, SMB Intelligence, May 2018. Available online.

4. Waters, Steve. “The Importance of Small Business Development Stages”, SMB Intelligence, May 2018. Available online.

5. Waters, Steve. “Growth-based Classification vs. Traditional Small Business Segmentation”, SMB Intelligence, May 2018. Available online.

6. Thirty-three percent of all owners reported job openings they could not fill in the current period. NFIB. “May 2018 Report: Small Business Optimism Index”, May 2018. Available online. 23% of employer firms who applied for credit did not receive any, and 54% had a financing shortfall, meaning they received less than what they applied for. Federal Reserve Bank. “2017 Small Business Credit Survey – Report on Employer Firms”, 2017. Available online. Right now resources are not, for whatever reason, getting to the right people and the right places to spur economic development—particularly in under-invested parts of the urban core. Knox, Ron. “The Hunt for an Entrepreneurial Ecosystem”, Citylab, September, 2017. Available online. Small business owners are often unaware of the many resources available to them, and struggle to navigate Boston’s currently disconnected business support environment. City of Boston Small Business Report, Page 27, March 2016. Available online. Majority of small business owners are missing opportunities to fund innovation. BMO Wealth Management.”Creating Wealth through Business Improvements”, June 2018. Available online. 81% of small business owners haven’t worked with local government funded small business resources eg. chamber of commerce, SCORE, SBA etc. Fifth Third Bank. “National Small Business Survey”, April 2016. Available online.

7. Economically distressed areas are being left behind with new business creation: more than half (54%) of the country’s distressed zip codes had fewer jobs and establishments in 2015 than they did in 2000, compared to 32% of all US zip codes and only 13% of prosperous zip codes. Economic Innovation Group, “2017 Distressed Communities Index”. Available online.

8. Kugler, Maurice and Marios Michaelides, Neha Nanda, Cassandra Agbayani, “Entrepreneurship in Low-Income Areas”, page 1, IMPAQ International LLC for Small Business Administration, September 2017. Available online.

9. Federal Reserve Banks of New York and Kansas City, “Small Business Credit Survey – Report on Women-Owned Firms”, November 2017. Available online.

10. Brookings Institute Hamilton Project, “Minority and Women Entrepreneurs: Building Capital, Networks, and Skills”, March 2015. Available online.

11. Klein, Joyce A. “Bridging the Divide: How Business Ownership Can Help Close the Racial Wealth Gap”, Aspen Institute, January 2017. Available online.

12. The Partnership for a New American Economy, “Open For Business – How Immigrants are Driving Small Business Creation in the United States”, August 2012. Available online

13. Klein, Joyce A. “Bridging the Divide: How Business Ownership Can Help Close the Racial Wealth Gap”, Aspen Institute, January 2017. Available online.

14. The average small business has less than a month of cash buffer days (meaning that if something happened that affected their revenue, they would have less than two months before they ran out of cash). 75% of owners have less than two months, 25% of owners have less than two weeks! JP Morgan Chase. “Cash is King: Flows, Balances and Buffer Days”, September 2016. Available online. 40% of owners have no financial backup plan in place. Reliant Funding. “Small Business Report November 2017”, November 2017. Available online.

15. CEB. “The 9 Traits Small Business Owners Share”, September 2015. Available online.

16. The term “small business owner” is used by analysts, economists, marketers and the media etc. Owners do not refer to or perceive themselves as small business owners, the perceive themselves as industry category specialists: “restaurant owner”, “hair salon owner”, “medical clinic owner” with specific needs. Small business owners perceive their businesses and their business needs as unique. CEB. “The 9 Traits Small Business Owners Share”, September 2015. Available online. After “easy to understand”, the next most important attribute for content is “for someone in my industry”. Bredin, “What makes content effective”, August 2014. Available online. Owners want content positioned for their industry. Tassin, Claire. “Cutting Through the Clutter: How Best To Reach A Small Business Audience”, CEB, January 2012. Available online

17. Waters, Steve. “The Three Mindsets of Small Business Owners”, SMB Intelligence, May 2018. Available online.

18. Richards, Stu. “Selling to SMBs via Peers and Influencers”, Bredin, October 2016. Available online. While 62% of owners seek guidance from their industry peers, only 25% seek it from community leaders, 12% from financial advisors and suppliers, and 8% from incubators / accelerators. UPS and Business Insider. “2016 State of Small Business”, 2016. Available online. The top resource small business owners rely on to run their business is “other business owners”, with 66% of owners reporting they rely on them. Shopkeep. “2018 Shopkeep Small Business Pulse”, May 2018. Available online.

19. Waters, Steve. “Most Small Business Owners are Motivated by Lifestyle – Not Growth”, SMB Intelligence, May 2018. Available online.

20. Waters, Steve. “Identifying the Small Businesses Most Receptive to New Solutions”, SMB Intelligence, May 2018. Available online.

21. Waters, Steve. “Which Firms are Most Likely to Experience Substantial Growth?”, SMB Intelligence, May 2018. Available online.

22. Waters, Steve. “These Firms are the Engine of Small Business Job Creation”, SMB Intelligence, May 2018. Available online.

23. Waters, Steve. “Growth-based Classification vs. Traditional Small Business Segmentation”, SMB Intelligence, May 2018. Available online.

24. Waters, Steve. “The Importance of Small Business Development Stages”, SMB Intelligence, May 2018. Available online.

25. The average small business has less than a month of cash buffer days (meaning that if something happened that affected their revenue, they would have less than two months before they ran out of cash). 75% of owners have less than two months, 25% of owners have less than two weeks! JP Morgan Chase. “Cash is King: Flows, Balances and Buffer Days”, September 2016. Available online. 40% of owners have no financial backup plan in place. Reliant Funding. “Small Business Report November 2017”, November 2017. Available online.

26. CEB. “The 9 Traits Small Business Owners Share”, September 2015. Available online.

27. Waters, Steve. “Growth-based Classification vs. Traditional Small Business Segmentation”, SMB Intelligence, May 2018. Available online.

28. The term “small business owner” is used by analysts, economists, marketers and the media etc. Owners do not refer to or perceive themselves as small business owners, the perceive themselves as industry category specialists: “restaurant owner”, “hair salon owner”, “medical clinic owner” with specific needs. Small business owners perceive their businesses and their business needs as unique. CEB. “The 9 Traits Small Business Owners Share”, September 2015. Available online. After “easy to understand”, the next most important attribute for content is “for someone in my industry”. Bredin, “What makes content effective”, August 2014. Available online. Owners want content positioned for their industry. Tassin, Claire. “Cutting Through the Clutter: How Best To Reach A Small Business Audience”, CEB, January 2012. Available online

29. Thirty-three percent of all owners reported job openings they could not fill in the current period. NFIB. “May 2018 Report: Small Business Optimism Index”, May 2018. Available online. 23% of employer firms who applied for credit did not receive any, and 54% had a financing shortfall, meaning they received less than what they applied for. Federal Reserve Bank. “2017 Small Business Credit Survey – Report on Employer Firms”, 2017. Available online. Right now resources are not, for whatever reason, getting to the right people and the right places to spur economic development—particularly in under-invested parts of the urban core. Knox, Ron. “The Hunt for an Entrepreneurial Ecosystem”, Citylab, September, 2017. Available online. Small business owners are often unaware of the many resources available to them, and struggle to navigate Boston’s currently disconnected business support environment. City of Boston Small Business Report, Page 27, March 2016. Available online. Majority of small business owners are missing opportunities to fund innovation. BMO Wealth Management.”Creating Wealth through Business Improvements”, June 2018. Available online. 81% of small business owners haven’t worked with local government funded small business resources eg. chamber of commerce, SCORE, SBA etc. Fifth Third Bank. “National Small Business Survey”, April 2016. Available online.

30. Waters, Steve. “The Importance of Small Business Development Stages”, SMB Intelligence, May 2018. Available online.

31. 68% of owners reported responding to cold outreach, 33% reported never responding. Alignable, “The Impact of Selling to Local Businesses”, May 2016. Available online. 74% email open rates and 22% click-through rates have been reported on email campaigns to prime growth firms using value propositions aligned to growth priorities and messaging relevant to industry. SMB Intelligence. “Case Studies June 2018”, Contact us to access.

32. Richards, Stu. “Selling to SMBs via Peers and Influencers”, Bredin, October 2016. Available online. While 62% of owners seek guidance from their industry peers, only 25% seek it from community leaders, 12% from financial advisors and suppliers, and 8% from incubators / accelerators. UPS and Business Insider. “2016 State of Small Business”, 2016. Available online. The top resource small business owners rely on to run their business is “other business owners”, with 66% of owners reporting they rely on them. Shopkeep. “2018 Shopkeep Small Business Pulse”, May 2018. Available online.

33. Economically distressed areas are being left behind with new business creation: more than half (54%) of the country’s distressed zip codes had fewer jobs and establishments in 2015 than they did in 2000, compared to 32% of all US zip codes and only 13% of prosperous zip codes. Economic Innovation Group, “2017 Distressed Communities Index”. Available online.

34. Kugler, Maurice and Marios Michaelides, Neha Nanda, Cassandra Agbayani, “Entrepreneurship in Low-Income Areas”, page 1, IMPAQ International LLC for Small Business Administration, September 2017. Available online.

35. Federal Reserve Banks of New York and Kansas City, “Small Business Credit Survey – Report on Women-Owned Firms”, November 2017. Available online.

36. Brookings Institute Hamilton Project, “Minority and Women Entrepreneurs: Building Capital, Networks, and Skills”, March 2015. Available online.

37. Klein, Joyce A. “Bridging the Divide: How Business Ownership Can Help Close the Racial Wealth Gap”, Aspen Institute, January 2017. Available online.

38. The Partnership for a New American Economy, “Open For Business – How Immigrants are Driving Small Business Creation in the United States”, August 2012. Available online.

39. Klein, Joyce A. “Bridging the Divide: How Business Ownership Can Help Close the Racial Wealth Gap”, Aspen Institute, January 2017. Available online.

40. If the number of people-of-color firms were proportional to their distribution in the labor force, people of color would own 1.1 million more businesses with employees. These firms would add about 9 million jobs and about $300 billion in workers’ income to the U.S. economy. Austin, Algernon. “The Color of Entrepreneurship”, Center for Global Policy Solutions, April 2016. Available online. The bulk of American communities have seen only modest advances since the Great Recession and still bear deep scars. Economic Innovation Group, “Escape Velocity – How Elite Communities are Pulling Away in the 21st Century Race for Jobs, Businesses and Human Capital”, 2018. Available online.