Small Business Sector Dynamics

The importance of small business development stages

Understanding our nine-stage model and the key insights from each stage.

By Steve Waters

Founder & CEO, SMB Intelligence

May 21, 2018

Background

Development stage refers to where a firm is in the lifecycle of their business. A seminal study published in Harvard Business Review1 in 1983 established that small businesses move through similar development stages, regardless of their size or industry, and face highly uniform challenges at each stage.

Why this matters

While the concept of development stages was created to help owners understand the business lifecycle and better prepare themselves for the challenges at each stage, they also provide highly useful insight into current growth motivation, receptivity to new solutions, growth priorities, growth propensity and job creation propensity.

The five key insights

Mindset

The current mindset of owners at this stage towards engaging with providers of solutions. Learn more about the three mindsets of small business owners.

Receptivity

How receptive or not owners at this stage are towards implementing new solutions in general. Learn more about small business receptivity.

Job creation propensity

The current likelihood that firms at this stage will create new jobs.

Substantial growth propensity

The current likelihood that firms at this stage will both substantially increase revenues and create new jobs (as opposed to incremental growth, which we define as gradually increasing revenues).

Current growth motivation

The likelihood that firms at this stage are currently motivated by growth – that they expect and want to experience substantial growth.

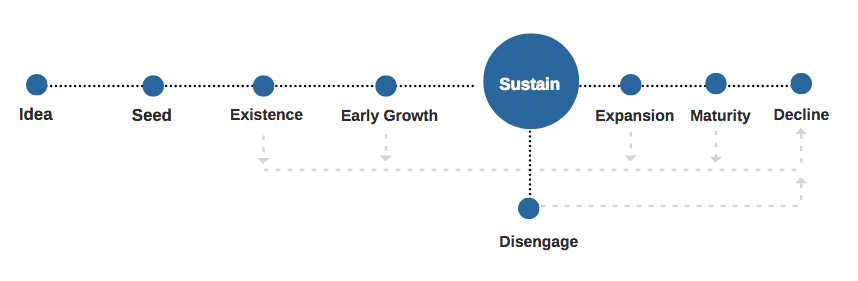

The nine stage model

SMB Intelligence has developed a model of nine development stages based on a combination of the work of Churchill & Lewis (1983)2, Lichtentstein and Lyons (2008)3, and our own experience in the ecosystem. Our model is specifically designed to be actionable for organizations that provide growth solutions to small business owners.

Idea

Begins with an idea for a business. Ends with the validation of the idea, a commitment to move forward, and a plan and schedule to launch the firm.

Mindset toward solution providers:

Not applicable as there is not yet a firm.

Receptivity to new solutions:

Very low – there is not yet a firm to implement solutions into.

Job creation propensity:

None – there is not yet a firm to create jobs for.

Substantial growth propensity:

None – there is not yet a firm to grow.

Growth motivation:

None – there is not yet a firm.

Seed

Begins with a commitment, plan, budget and schedule to launch the firm. Ends when the firm is open for business, with a product / service available for purchase.

We define a firm to be at seed stage when they are a new, pre-revenue, pre-opening firm currently planning their launch.

Mindset towards solution providers:

Sourcing – mental bandwidth is focused on engaging with providers of solutions.

Receptivity to new solutions:

High – owners at seed stage are sourcing all of the solutions they need to launch and operate, and have allocated funds to acquire these solutions.

Job creation propensity:

High if they are an employer firm – they need to hire the initial employees necessary to startup and launch.

Substantial growth propensity:

High if they are an employer with a commercial location – the new firm is starting from zero and needs to hire initial employees, and is poised to launch and start generating revenues.

Current growth motivation:

High – they have committed to launching a new firm and are in the startup process.

Existence

Begins when the firm is open for business and has a product / service for purchase. Ends when the firm breaks even on sales.

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Low – firms at existence stage have usually expended their startup budget, have at least the minimum they need to operate, and are now in a race against time to break even.

Job creation propensity:

Low – generally a firm has expended their startup budget, has already hired their initial employees, and are now in a race against time to break even before they run out of cash.

Substantial growth propensity:

Low – focus is on breaking even, some firms won’t survive existence stage4, and the vast majority of firms start small and stay small5.

Growth motivation:

Moderate – firms at existence are still working to break even, so have to be currently motivated by growth to some extent just to ensure their continued survival.

Early Growth

Begins when the firm breaks even on sales. Ends with the establishment of a sustainable firm – they have average or above profits.

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Low – firms generally have the solutions they need in place at this point, and are unlikely to switch.

Job creation propensity:

Low – firms will generally have the employees they need in place and are in a race against time to reach profitability before they run out of cash. The vast majority of firms do not grow year over year by adding employees6.

Substantial growth propensity:

Low – firms at early growth are still fighting to become profitable, some won’t survive early growth stage7, and the vast majority of firms start small and stay small8.

Growth motivation:

Moderate – firms are in a dash to become profitable, even if they aren’t generally motivated by growth, they have to be to some extent at early growth stage to generate a profit.

Sustain

Begins with the establishment of a sustainable firm – they have average or above profits. Ends if the firm moves into a decline stage, decides to pursue expansion, or the owner disengages and focuses attention elsewhere. Most surviving firms exist within a sustain or disengage stage.

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Low – firms generally have the solutions they need in place at this point and have been operating with them long enough to become profitable, and are unlikely to switch, unless they hit a breaking point with a specific solution.

Job creation propensity:

Low – firms at sustain stage have managed to make their business profitable, and this is where the majority of surviving small businesses remain – as a sustainable firm. The vast majority of small businesses do not grow by adding employees year over year, even over a three year period9.

Substantial growth propensity:

Low – the vast majority of firms don’t experience substantial growth, even over a three year period10.

Growth motivation:

Low – most firms who create a sustainable business are no longer motivated to grow – they have accomplished what they set out to do, which is to create a small, financially sustainable, lifestyle business.

Disengage

Begins with a sustainable firm with average or above profits. The focus becomes maintaining the status quo, and the owner focuses their attention elsewhere in life. Ends if the firm moves into a decline stage, or decides to pursue expansion. Most surviving firms exist within a sustain or disengage stage.

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Low – firms at disengage stage have what they need to operate and they are focused on maintaining the status quo, unless they hit a breaking point with a specific solution.

Job creation propensity:

Low – the focus is on maintaining the status quo.

Substantial growth propensity:

Low – the focus is on maintaining the status quo.

Growth motivation:

Low – the focus is on maintaining the status quo.

Expansion

Begins with a sustainable firm with average or above profits that decides to marshal their resources to expand. Ends when the firm has achieved the benefits of size and scale, a strong market position, and is profitable, but growth has slowed.

We define a firm to be at expansion stage when they are currently planning to add an establishment, relocate the firm or an establishment, or have recently raised substantial outside funding.

Mindset towards solution providers:

Operating and sourcing. Owners at an expansion stage are both operating using existing solutions, but also marshaling resources for their expansion. They are likely to return to a sourcing mindset as they review their existing operations and consider sourcing new solutions to support their expansion.

Receptivity to new solutions:

Moderate to high – expansion stage is often an inflection point as owners take stock of their current situation and determine what is necessary to support their expansion.

Job creation propensity:

High – expansion stage firms often need new employees to operate new establishments, will use raised funds to substantially increase employee count, or will create new jobs in a new area after relocating the firm or an establishment.

Substantial growth propensity:

High – the firm has demonstrated the ability to become a sustainable firm, and is now planning to scale that success through expansion.

Growth motivation

High – firms at an expansion stage have chosen to take their sustainable firm and marshal resources for expansion.

Maturity

Begins when a growth firm has achieved the advantages of size and stability, is profitable, but growth has slowed. It ends when market share begins to decline due to complacency

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Low – firms at maturity stage have the solutions they need to operate and are unlikely to switch unless they hit a breaking point with a specific solution.

Job creation propensity:

Low – the firm has reached maturity, growth has slowed, and the focus is on maintaining the status quo and/or increasing profitability with existing resources.

Substantial growth propensity:

Low – growth has slowed.

Growth motivation:

Low – growth has slowed.

Decline

Begins when due to complacency or a desire to avoid risk, market share declines. Ends when the firm is sold or closed, or manages to reinvent itself.

Mindset towards solution providers:

Operating, possible breaking point. Mental bandwidth is focused on operating with existing solutions not engaging with new providers, unless they hit a breaking point where a specific solution stops functioning or becomes too painful to continue, in which case mental bandwidth focuses on engaging with providers for that specific solution.

Receptivity to new solutions:

Very low – firms at a decline stage generally have more pressing challenges than changing providers or finding new ones.

Job creation propensity:

Low – at this stage job destruction is likely to happen.

Substantial growth propensity:

Low – they are usually moving in the opposite direction.

Growth motivation:

Low.

1,2. Churchill, Neil C. and Virgina L. Lewis. “The Five Stages of Small Business Development”, Harvard Business Review, May 1983. Available online.

3. Lichtenstein, Gregg A. and Thomas S. Lyons. “Revisiting the Business Life-Cycle: Proposing an Actionable Model for Assessing and Fostering Entrepreneurship”, The International Journal of Entrepreneurship and Innovation, November 2008. Available online.

4,7. SBA, “Small Business Survival Rates and Firm Age”, 2017. Available online

5,6,8,9,10. Pugsley, Benjamin Wild and Erik Hurst. “What Do Small Businesses Do?”, Brookings Papers On Economic Activity, Fall 2011. Available online.