The Prime Growth Framework for

Qualified

Opportunity Funds

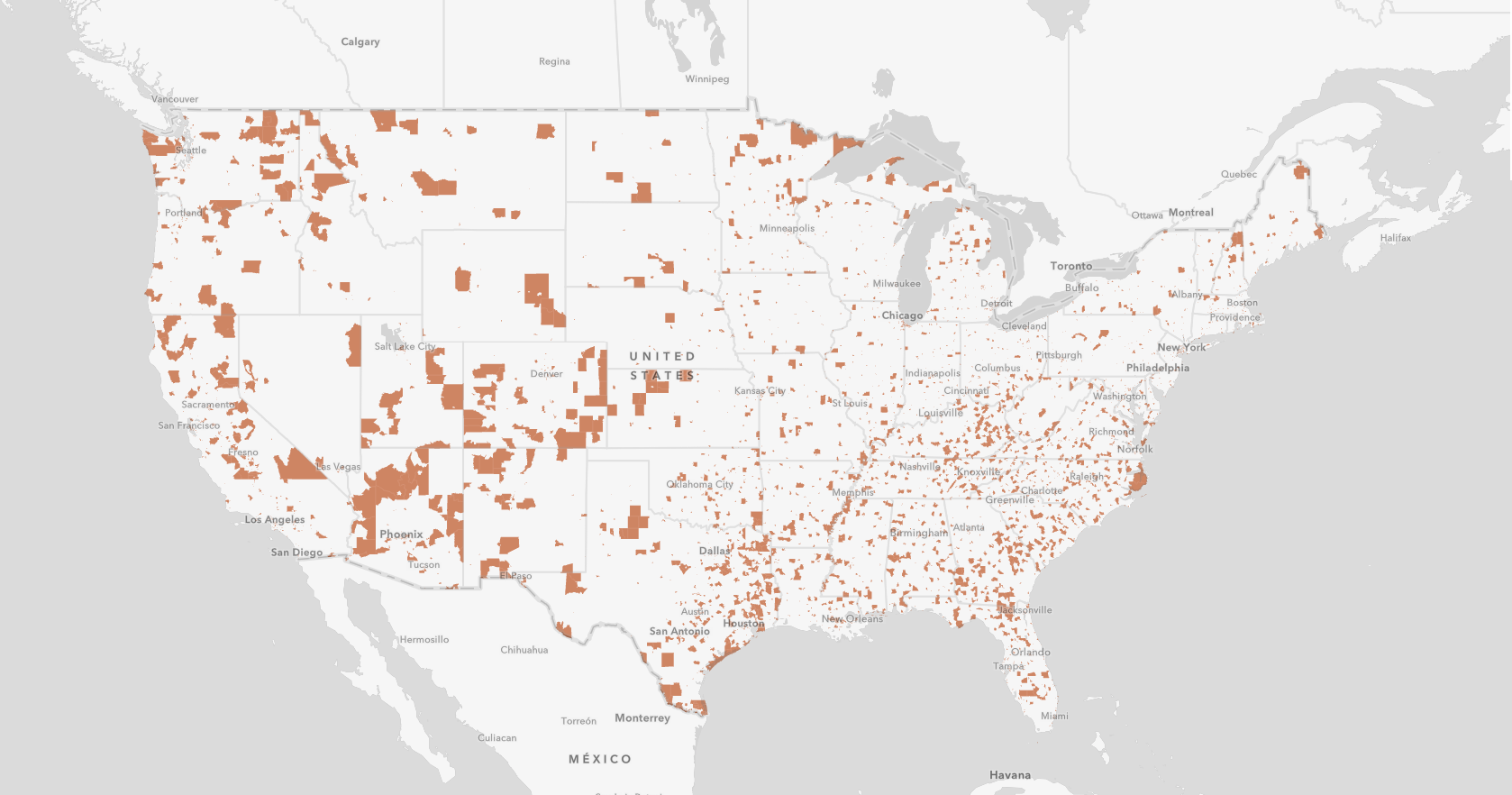

Maintain a continually updated portfolio of “investable operating businesses” in Opportunity Zones (OZ), as well as current prime growth activity in areas surrounding OZ’s signaling the entrepreneurs most likely to expand in, relocate to, or build a new business in an OZ.

Gain a competitive advantage for your fund in a cost-effective manner, and be first to identify potential opportunities.

SMB Intelligence is a member of the national Opportunity Zones Coalition, led by Economic Innovation Group, and produces the leading market intelligence on small business sector activity relevant to OZ investment. Our work with OZ’s was recently featured in Route Fifty and Impact Alpha.

Overview

Key Features

1. Defining investable operating businesses

2. Defining prime growth activity

3. Sector monitoring

4. The Prime Growth Briefing

5. Portfolio alignment

6. Impact insights

Defining an “investable operating business”

a) A new, seed stage independent2 currently planning their launch, that will be an employer firm3 with a commercial location4 within an OZ likely acquired after Dec. 31, 2017.

b) An existing, recently opened independent, that is an employer, with a commercial location within an OZ likely acquired after Dec. 31, 2017.

c) An existing, expansion stage small chain5 that is currently planning to add an establishment within an OZ, at a commercial location likely acquired after Dec. 31, 2017.

d) An independent or small chain currently planning to relocate their firm, or an establishment, to a commercial location within an OZ, likely acquired after Dec. 31, 2017.

The businesses can be in any industry, other than a few “sin businesses”6 excluded from the program.

Notes on restrictions as of November 2018:

70% of a company’s tangible property has to be in a designated area.

Most of the firms we identify would meet this threshold.

Generate at least 50% of their gross income within the zone they operate.

As most of the firms we identify are local businesses, many would meet this threshold. However, we believe this restriction severely limits the possibility of investing in high-growth firms and is at odds with the intent of the legislation. We are optimistic it will be revised or eliminated in the next round of regulations. This is why we also identify otherwise qualified, high-growth firms that would not currently meet this threshold.

Substantially all of the tangible property owned or leased by the company is qualified opp zone business property.

Most independents we identify would meet this threshold.

Small local chains adding establishments within opportunity zones.

We also identify local chains adding establishments in OZ, as dependent on the structure of their legal entities, they may or may not meet the above restrictions. We are optimistic this will also be addressed in the next round of regulations.

1. A small business is defined as an independent or small chain.

2. Independent is defined as a single establishment (location) firm with less than 500 employees. It’s important to note that while we include firms with up to 500 employees, nearly all (98%) of small businesses have less than 100 employees, and 96% have less than 50.

3. Employer firm is defined as a firm with employees beyond the owner.

4. Commercial location is defined as a place of business that is not a residence.

5. Small chain is defined as a firm with between 2-20 establishments. This also includes firms with several office locations, that are not traditionally viewed as a “chain”.

6. Sin businesses are defined by §144(c)(6)(B) as a private or commercial golf course, country club, massage parlor, hot tub facility, suntan facility, racetrack or other facility used for gambling, or any store the principal business of which is the sale of alcoholic beverages for consumption off premises.

Designated Opportunity Zones. Image from Economic Innovation Group

Defining prime growth activity in areas surrounding OZ’s

a) A new, seed stage (pre-opening) independent currently planning their launch, that will be an employer firm with a commercial location.

b) An existing, expansion stage small chain that is currently planning to add an establishment(s).

c) An independent or small chain currently planning to expand by relocating their firm or an establishment.

d) An independent or small chain that has recently raised a substantial round of outside funding.

Why this matters

These are the entrepreneurs currently most likely to expand into, relocate to, or build a new business in an OZ, and provides high-level context as to planned small business growth activity in the region.

Continually monitor the small business sector

Sector Monitoring

SMB Intelligence uses proprietary open-source intelligence (OSINT) methods applied through a combination of machine analysis and human analytics.

We continually monitor over 30,000 real estate, editorial, public government data, social media and other sources to track planned growth activity in the small business sector.

We apply Prime Growth Classification to that dataset to identify & segment prime growth firms, and then aggregate additional data points to determine key characteristics including their current job creation status, contact details and digital engagement.

We then geocode each prime growth firm, assign a US Census tract, determine Opportunity Zones status, and use extensive public government data to determine the current socioeconomic status of the community each firm is located in.

Why this matters

New investable firms are continually launching, and prime growth activity surrounding OZ’s continually changes, as the sector churns with new firms entering, failed firms exiting and surviving firms moving through development stages.

Maintain a portfolio of investable operating small businesses, and prime growth activity outside OZ’s

The Prime Growth Briefing

Published every two weeks, The Prime Growth Briefing is a powerful dataset that identifies investable operating small businesses located in OZ’s, as well as prime growth activity in areas surrounding OZ’s.

View the available data points in the Briefing.

Why this matters

Traditional small business datasets and segmentation do not provide insight into investable operating businesses or prime growth activity.

SMB Intelligence is the only organization to monitor the small business sector using growth-based classification, to identify investable operating businesses, and to identify prime growth activity in areas surrounding OZ’s.

Data Validation

The Prime Growth Briefing is the most current and accurate small business dataset available. We take extensive steps to ensure the veracity of the data we provide, and to present it to clients in a transparent manner.

Prioritize firms based on their current growth priorities

Growth priorities refer to the big picture context of an owner’s current growth plans – the format and scale of growth they are currently working to accomplish.

Why this matters

When you can determine current growth priorities you can identify the firms most relevant to your portfolio.

The eight segments:

Seed – New Firm

New, seed stage, pre-revenue, pre-opening firms currently planning to launch their firm.

Seed – Encore

New, seed stage, pre-revenue, pre-opening firms currently planning to launch their firm, with an owner who has previous entreprenuerial experience.

Seed – Funded

New, seed stage, pre-revenue, pre-opening firms currently planning to allocate recently raised funds to launch their firm.

Expansion – Initial

Existing, expansion stage firms, currently planning to expand their single establishment firm into a small chain by adding a second establishment.

Expansion – Emerge

Existing, expansion stage, emerging small chains with 3-10 establishments, that are currently planning to expand by adding an establishment.

Expansion – Advance

Existing, expansion stage, advanced small chains with 11-20 establishments, that are currently planning to expand by adding an establishment.

Expansion – Velocity

Existing, expansion stage firms, that are currently planning rapid expansion by adding multiple new establishments at once.

Expansion – Relocate

Existing, expansion stage firms, that are currently planning to expand by relocating their firm or an establishment to a new location within an Opportunity Zone.

Increase your impact

Social impact insights

The Prime Growth Briefing provides deep socioeconomic insight into both the owners and the community the firms are located in.

Understand the socioeconomic details of each zone:

• Area Economic Index: how economically distressed or advantaged the zone is in relation to it’s surrounding metro.

• Zone Investment Flow – the level of commercial, multi-family, single-family and small business lending already flowing into the tract.

• Recent gentrification (if any) – if the tract has recently experienced high levels of socioeconomic change.

• Concentrated poverty – if the zone is an area of concentrated poverty

• Disaster area – if the zone is located in a FEMA designated disaster area

Identify firms that are:

• Minority-owned

View the available social impact data points in the Briefing.

Why this matters

Prime growth firms are the small businesses currently most likely to be motivated by growth13 and receptive to new solutions14, and if successful in their growth plans, to experience substantial growth15 and create new jobs16.

When you can identify prime growth firms in economically distressed communities and with underserved owners, and deliver capital to support their current growth priorities, you can increase the social impact of your fund.

13. Waters, Steve. “Most Small Business Owners are Motivated by Lifestyle – Not Growth”, SMB Intelligence, May 2018. Available online. 14. Waters, Steve. “Identifying the Small Businesses Most Receptive to New Solutions”, SMB Intelligence, May 2018. Available online 15. Waters, Steve. “Which Firms are Most Likely to Experience Substantial Growth”, SMB Intelligence, May 2018. Available online. 16. Waters, Steve. “These Firms are the Engine of Small Business Job Creation”, SMB Intelligence, May 2018. Available online.

Deliverables

Datasets

Portfolio of Investable Operating Businesses

Delivered in CSV format via email.

The Prime Growth Briefing

Updates on both new investable operating businesses and current prime growth activity in areas surrounding OZ’s. The Briefing is published every two weeks and delivered in CSV format via email.

View the available data points.

Social Impact Insights

Delivered as data fields within the Prime Growth Briefing.

View the available data points.

Strategic insight

Prime Growth Classification User Guide

A guide to understanding how and why to use Prime Growth Classification, delivered in PDF format.

Pricing / Eligibility

In order to prevent abuse of this service we verify the identity of the managers of all Opportunity Funds, and proof of assets under management may be required. Funds are required to have an active website and a business email (not anonymous Gmail, Outlook etc.).