Small Business Ecosystem Dynamics

Quantifying prime growth firms

At any given time how many prime growth small businesses are there in the US?

By Steve Waters

Founder & CEO, SMB Intelligence

Apr. 15, 2018

Background

Developed by SMB Intelligence in 2018, Prime Growth is a growth-based classification standard for the small business sector. Growth-based classification uses development stage, growth format and growth scale to categorize firms rather than traditional small business segmentation (revenues, company age, company size, and digital engagement).

The purpose of the standard is to identify current prime growth firms and segment them by their current growth priorities.

What are prime growth firms?

Prime growth firms are independents or small chains, that are employers, with a commercial location(s), that are currently at a seed (new) or expansion (high growth) development stage. They are the small businesses currently most likely to be motivated by growth1 and receptive to new solutions2, and if successful in their current growth plans, to experience substantial growth3 and create new jobs4.

The big question

How many small businesses are considered prime growth?

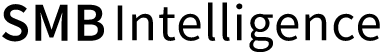

Employers with commercial locations

There are 29.6 million small businesses5, of which 20% are employers6, giving us 5.92 million employers. 77% of employers have a commercial location7, leaving us with 4.56 million employers with a commercial location.

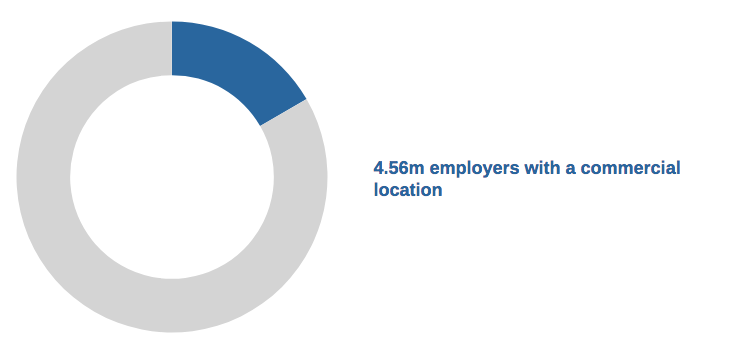

Seed and expansion stage

While data doesn’t currently exist to determine the number of firms presently at each development stage, we can use existing data from the US Bureau of Labor Statistics to give us an estimate.

We know that 8% of employer small businesses are less than one year old8, which we can use as a rough proxy for firms at seed stage. If we estimate that approximately half of small businesses under one year old are currently at seed stage (pre-revenue, pre-opening), then we would have 182,400 (4% of 4.56 million) employers with commercial locations at seed stage.

We also know that only 2% of all firms are considered high growth9, which we can use as a rough proxy for expansion stage.

Ignoring that a few of the 2% would not be small businesses (the vast majority of high growth firms are small businesses10), and that roughly 14% of high growth firms are under one year old11 so there would be a small overlap with firms that are also under one year old, approximately 91,200 (2% of 4.56 million) of employers with commercial locations would be at an expansion development stage.

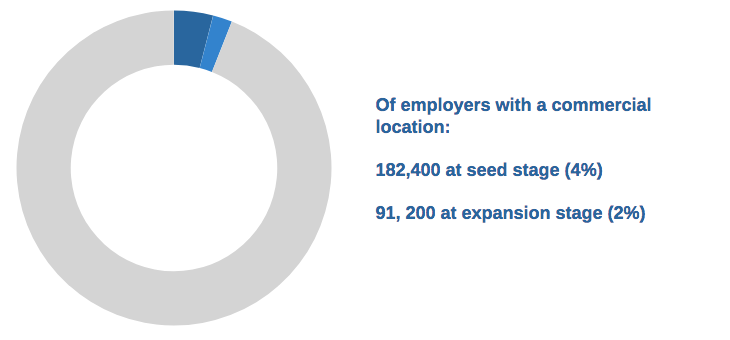

The bottom line

If we add the 182,400 at seed stage, and the 91,200 at expansion stage, we end up with approximately 273,600 prime growth firms at any given time. 6% of employers with a commercial location, or 1% of all small businesses.

1. Waters, Steve. “Most Small Business Owners are Motivated by Lifestyle – Not Growth”, SMB Intelligence, May 2018. Available online.

2. Waters, Steve. “Identifying the Small Businesses Most Receptive to New Solutions”, SMB Intelligence, May 2018. Available online

3. Waters, Steve. “Which Firms are Most Likely to Experience Substantial Growth”, SMB Intelligence, May 2018. Available online.

4. Waters, Steve. “These Firms are the Engine of Small Business Job Creation”, SMB Intelligence, May 2018. Available online.

5, 6, 7, 8. Small Business Administration. “Small Business FAQ”, August 2017. Available online.

9, 10, 11. Richard Clayton, Akbar Sadeghi, David Talan, and James Speltzer. “High-employment-growth firms: defining and counting them”, Monthly Labor Review, US Bureau of Labor Statistics, June 2013 Available online.